How Credit Rating Repair Works to Get Rid Of Mistakes and Boost Your Credit Reliability

Credit scores fixing is a vital procedure for individuals seeking to enhance their credit reliability by addressing errors that may jeopardize their financial standing. By carefully taking a look at debt reports for common errors-- such as inaccurate individual information or misreported settlement histories-- people can launch a structured disagreement process with debt bureaus. This not only remedies incorrect info yet can also cause significant renovations in credit report. The effects of these corrections can be extensive, influencing every little thing from funding authorizations to rate of interest. Comprehending the subtleties of this process is vital for attaining optimum outcomes.

Comprehending Credit History Reports

Credit rating records function as a monetary snapshot of a person's credit report, describing their loaning and settlement actions. These reports are put together by credit report bureaus and include vital details such as charge account, arrearages, settlement history, and public records like liens or bankruptcies. Banks utilize this information to assess a person's creditworthiness when looking for loans, debt cards, or home loans.

A credit history report normally includes personal details, consisting of the individual's name, address, and Social Protection number, together with a checklist of credit scores accounts, their standing, and any late settlements. The record additionally outlines credit report questions-- instances where loan providers have actually accessed the record for analysis purposes. Each of these components plays a crucial function in establishing a credit rating, which is a mathematical depiction of credit reliability.

Recognizing credit scores reports is vital for consumers intending to manage their monetary health and wellness successfully. By on a regular basis examining their records, individuals can guarantee that their credit score background precisely mirrors their economic actions, therefore placing themselves positively in future borrowing ventures. Understanding of the components of one's credit report is the primary step towards effective credit history fixing and overall financial health.

Usual Credit Score Record Errors

Errors within credit scores reports can dramatically affect an individual's credit report and overall economic health and wellness. Common credit rating record errors consist of inaccurate personal details, such as wrong addresses or misspelled names. These disparities can result in confusion and might impact the evaluation of creditworthiness.

Another frequent error entails accounts that do not come from the person, usually resulting from identity burglary or inaccurate data access by financial institutions. Blended data, where a single person's credit details is incorporated with another's, can additionally happen, particularly with people that share similar names.

In addition, late payments may be inaccurately reported as a result of processing mistakes or misconceptions pertaining to payment dates. Accounts that have been worked out or settled might still look like impressive, more complicating an individual's credit score profile.

Moreover, mistakes pertaining to credit line and account equilibriums can misstate a customer's credit rating utilization proportion, a vital factor in credit history. Identifying these mistakes is important, as they can bring about higher rate of interest, finance rejections, and increased difficulty in obtaining credit rating. On a regular basis assessing one's credit scores report is a positive measure to identify and correct these usual errors, hence guarding financial health.

The Credit Scores Fixing Process

Browsing the credit rating repair procedure can be a complicated job for several people looking for to enhance their monetary standing. The journey starts with obtaining a detailed debt record from all three significant credit bureaus: Equifax, Experian, and TransUnion. Credit Repair. This allows consumers to recognize and comprehend the aspects impacting their credit score scores

As soon as the credit record is examined, people should categorize the info right into exact, incorrect, and unverifiable items. Precise information should be kept, while inaccuracies can be opposed. It is important to collect supporting documentation to substantiate any claims of mistake.

Following, individuals can select to either deal with the procedure separately or get the assistance of professional credit repair service services. Credit Repair. Specialists typically have the competence and sources to browse the complexities of credit reporting legislations and can improve the process

Throughout the credit history repair process, maintaining prompt payments on existing accounts is vital. This demonstrates responsible monetary behavior and can favorably impact credit scores. Eventually, the debt repair work procedure is a methodical approach to determining problems, challenging inaccuracies, and cultivating much healthier financial habits, bring about boosted creditworthiness in time.

Disputing Inaccuracies Effectively

An efficient disagreement procedure is vital for those aiming to rectify mistakes on their debt records. The primary step entails getting a duplicate of your credit history report from the major credit scores bureaus-- Equifax, Experian, and TransUnion. Review the report diligently for any kind of discrepancies, such as inaccurate account details, obsoleted information, or deceptive entries.

Next, start the disagreement process by getting in touch with the credit history bureau that issued the report. When sending your conflict, provide a clear description of the error, along with the sustaining proof.

Benefits of Credit History Repair Work

A wide variety of benefits comes with the procedure of credit rating fixing, significantly affecting both economic stability and overall lifestyle. Among the primary benefits is the capacity for improved credit rating. As errors and errors are dealt with, individuals can experience a noteworthy rise in their credit reliability, which directly affects financing approval prices read here and rate of interest terms.

Additionally, credit rating fixing can improve access to positive financing choices. Individuals with greater credit report are most likely to get approved for lower rate of interest on home loans, car loans, and individual finances, eventually leading to significant cost savings in time. This better financial adaptability can facilitate major life choices, such as purchasing a home or investing in education and learning.

Moreover, a healthy credit report profile can improve self-confidence in financial decision-making. With a clearer understanding of their credit situation, individuals can make informed options concerning credit look at here now usage and administration. Last but not least, credit history repair frequently entails education and learning on economic proficiency, encouraging people to take on far better investing behaviors and keep their credit rating health long-lasting. In summary, the benefits of credit history repair work extend beyond mere rating improvement, adding to a much more protected and thriving economic future.

Verdict

In final thought, credit repair serves as an important system for improving credit reliability by attending to mistakes within debt records. By recognizing the subtleties of credit score records and using reliable disagreement methods, people can accomplish higher financial wellness and security.

By diligently checking out credit records for typical go to website errors-- such as incorrect individual details or misreported payment histories-- people can start an organized dispute procedure with credit rating bureaus.Credit rating records offer as a financial photo of a person's credit score history, detailing their loaning and repayment actions. Understanding of the contents of one's credit rating record is the very first action toward effective credit score repair service and overall economic well-being.

Mistakes within credit report reports can dramatically affect an individual's debt rating and overall financial wellness.Additionally, inaccuracies concerning credit score limits and account equilibriums can misstate a customer's credit report utilization ratio, a vital factor in credit history scoring.

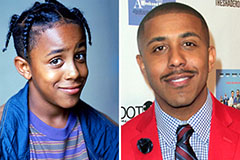

Marques Houston Then & Now!

Marques Houston Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!