Little Known Facts About Frost Pllc.

Table of ContentsSome Ideas on Frost Pllc You Need To KnowWhat Does Frost Pllc Do?The Main Principles Of Frost Pllc The Facts About Frost Pllc Uncovered

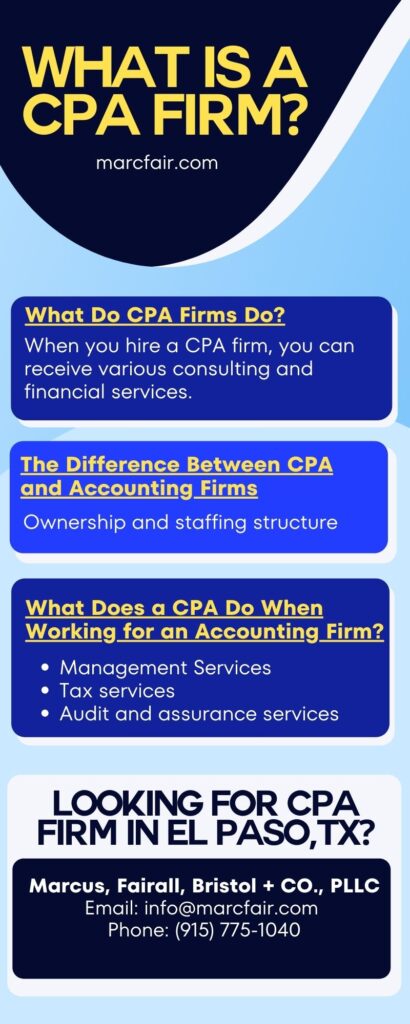

When it concerns financial services, there are several various kinds of firms offered to select from. Two of one of the most usual are accounting firms and CPA companies. While they may seem similar on the surface, there are some essential differences between the two that can impact the kind of solutions they offer and the qualifications of their personnel.Among the vital differences between audit companies and certified public accountant firms is the credentials needed for their personnel. While both kinds of companies may use accountants and various other monetary professionals, the 2nd one call for that their team hold a certified public accountant permit which is approved by the state board of book-keeping and calls for passing an extensive exam, meeting education, and experience requirements, and sticking to strict honest standards.

While some might hold a bachelor's degree in bookkeeping, others may have just completed some coursework in audit or have no formal education and learning in the field at all. Both bookkeeping companies and certified public accountant companies use a series of economic solutions, such as bookkeeping, tax obligation prep work, and economic planning. However, there are significant distinctions in between the services they supply.

These regulations might include requirements for proceeding education, ethical requirements, and quality control treatments. Accountancy firms, on the other hand, might not be subject to the same level of policy. However, they may still be called for to comply with certain requirements, such as usually accepted bookkeeping concepts (GAAP) or international monetary coverage standards (IFRS).

Some Known Details About Frost Pllc

These services may include tax obligation planning, audit services, forensic bookkeeping, and calculated data-driven analysis (Frost PLLC). The extent of services offered by CPA firms can differ greatly depending upon their size and focus. Some may specialize entirely in audit and assurance solutions, while others may use a bigger variety of solutions such as tax preparation, venture threat administration, and consulting

Certified public accountant firms may specialize in serving specific sectors, such as medical care, money, or genuine estate, and tailor their solutions as necessary to fulfill the unique needs of clients in these sectors. There are differences in the fee structures of audit companies and Certified public accountant companies. Accountancy companies might charge hourly prices for their services, or they may provide flat fees for certain tasks, such as bookkeeping or financial statement preparation.

Senior Manager and CPA with over twenty years of experience in accounting and economic services, focusing on risk management and regulatory conformity. Knowledgeable in managing audits and leading teams to supply phenomenal solutions. Honored dad of two. Kevin Mitchell LinkedIn Recommendations: Orzech, J. (2018, March 14). The Difference In Between a CPA click here for more info Company and an Accountancy Company.

Not known Factual Statements About Frost Pllc

Numerous audit company leaders have figured out that the traditional partnership model is not the method of the future. At the same time, investor passion in specialist services companies is at an all-time high.

All prove solutions are done just by the certified public accountant company and supervised by its proprietors. The CPA company and the services firm become part of a services arrangement, according to which the solutions business may offer specialist team, workplace area, devices, technology, and back-office features such as invoicing and collections. The CPA company pays the solutions firm a fee in exchange for the services.

The complying with are several of the key considerations for CPA companies and investors pondering the development of an alternative method structure. Certified public accountant strong possession demands are developed partially to insulate prove services and associated judgments from marketplace pressures. That means a certified public accountant firm offering prove services have to stay a different lawful entity from the aligned services business, with distinctive controling documents and governance frameworks.

The lower line is that celebrations to an alternative technique framework need to carefully analyze the appropriate freedom routines and carry out controls to keep track of the certified public accountant company's self-reliance - Frost PLLC. Many alternate method framework purchases involve the transfer of nonattest engagements and related documents. Events have to think about whether client authorization is called for and ideal notification even when approval is not needed

The 4-Minute Rule for Frost Pllc

Frequently, any type of retirement arrangement existing at the CPA company is ended in connection with the transaction, while places and calls reference might apply to companion owned equity in the solutions company. Associated with the financial considerations, certified public accountant companies require to think about exactly how the future generation of firm accountants will certainly be rewarded as they achieve seniority that would typically be accompanied by partnership.

Both investors and certified public accountant firms will require to stabilize the competing rate of interests of staying clear of dilution while correctly incentivizing future firm leaders. Investors and certified public accountant firms require to attend to post-closing governance issues in the services firm. A financier taking into consideration a control investment (and associated administration) in the services firm must think about the broadened reach of the auditor self-reliance regulations in that scenario as contrasted to a minority investment.